Loving my Barclaycard bPay pay band (and paying with my contactless cufflink)

I’ve always liked the idea of contactless.

Two years ago I took up the ‘contactless challenge’ from the team at Gemalto and tried out a series of tasks with the Gemalto supplied contactless SIM (in the Galaxy S4). It was a superb experience which really reinforced just how much I loved the concept of contactless.

The idea of a ‘pay band’ — a little piece of plastic containing a contactless module that’s worn on your wrist — was intriguing.

First, let me say, I don’t want to wear a band. I don’t wear a watch. But, given we’re talking ‘contactless’, I thought it was worth a shot.

I ordered by Barclaycard bPay band from the website and a day or so later it arrived. It was totally ‘free’ but of course in order to use it, you need to top it up with some money. It’s effectively a stand-alone PAYG debit card that you need to ‘load’.

You can choose a few colours. I opted for black.

It arrives in a nice funky case:

To activate, all I needed to do was log on to the bPay website and type in the serial number shown on the reverse of the band. Job done. It took about 30 seconds to do that and load on my first £25. I also checked the ‘auto top up’ feature which has been seriously useful.

How It Works

It’s actually a MasterCard contactless module inside the band.

I was quite surprised when I did my first transaction (see the cufflink bit coming up). I’m accustomed to contactless payments being done in a tap. I forgot that the bPay needs to be authorised first. So although the tap is just as fast as you’d expect, there’s a slight delay whilst the terminal calls up to check you’ve actually got the money in your account. Nay bother.

In The Bar

At the Grand Union bar in Farringdon this evening I wanted to buy a coke. £2.95. Arse. Anyway I asked if they had contactless. The chap nodded. I then explained I’d like to pay with my band.

His eyes widened.

He then explained, “There’s normally a £10 minimum charge for cards, but I want to see this working, so don’t worry.”

I took the coke and he brought over the terminal. I stuck my wrist over it like a magician. Two ladies standing next to me waiting to be served were momentarily amazed. The barman was suitably impressed. I really enjoyed the liberating feeling of not needing to arse about with wallets or money.

On The Bus

I looked like a total genius (at least, in my eyes) when I got on the number 521 bus this evening at Waterloo. I decided to go in the side entrance to the bus (at the back) rather than the front. I thought the distraction of the bPay might be a little too much for the driver.

I confidently strode up to the Oyster terminal and waited whilst everyone else messed around with wallets and Oyster cards. I then proceeded to briefly tap my wrist on the terminal.

“Card charged,” came the immediate message.

“Niiiiice,” I said to myself as the lady behind did a double-take. Mwhahahaha.

Working in Swindon I haven’t really had occasion to use the band on the tube yet. But I will. I definitely will. I can’t wait to do a Jedi wave over the Oyster terminal.

And I need to do the same at McDonalds, WH Smith and Pret.

The Contactless Cufflink

At the work dry cleaning concession yesterday I jokingly said to the lady that I’d like to pay with my cufflink. She looked at me, wondering if I was being serious. She held out the payment terminal and I reached across and tapped my cuff. I usually wear a proper double cuff shirt so the band wasn’t visible. It worked, of course. She was seriously impressed. I felt I had to tell her the reality lest she start telling folk about the company’s latest cufflink contactless system. I took off the band and held it over for her to take a look at. She was still impressed!

Auto Top-up is Really Useful

I really do like how, theoretically, I am completely sorted with contactless thanks to the band. I can now go out for the day in London without having to think about a wallet, credit cards or money. The auto top-up function is seamless and I’ve used it a few times this week as I paid for some expensive dry cleaning. The bPay website provides all the data you’d expect and you get email notification of top-ups.

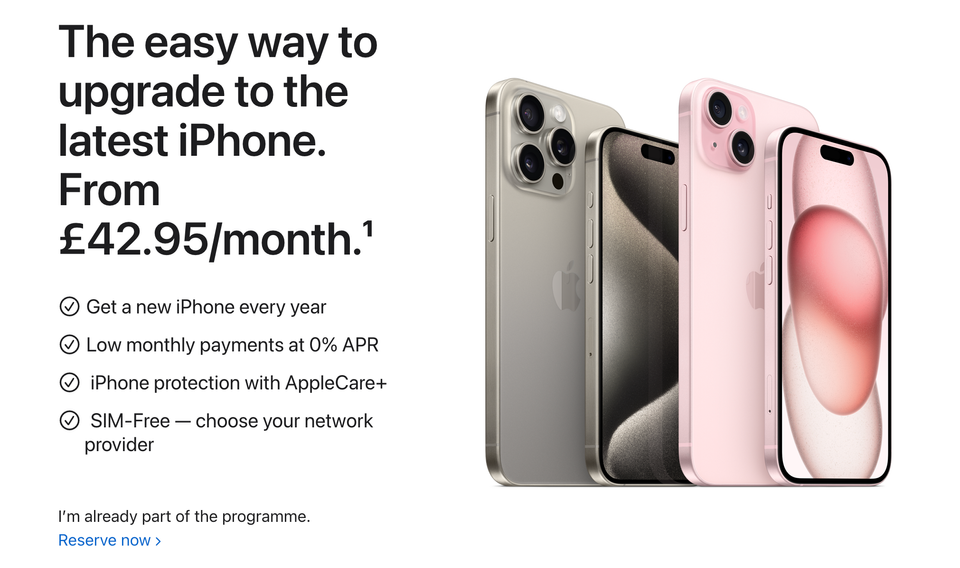

I’d like a Credit bPay

I would like a bPay configured with my Barclaycard credit card so that I don’t need to worry about the actual top-up functionality. I can theoretically fix this, by messing around with my Barclaycard paytag. I still haven’t popped it out as I like showing it to folk. Alas the little sticker is a bit to big to fit into the bPay band holder. I can definitely foresee a time when I am automatically sent a bPay module, paytag and credit card every few years, along with a throw-away set of credentials for use online, rather than just a solitary plastic credit card.

Security Doesn’t Concern Me

A friend of mine at the bar this evening was asking what I’d do if I lost my bPay and “Isn’t that dangerous?” from a fraud standpoint.

It’s as dangerous as having a contactless card. But it’s way, way better. In fact, it’s potentially significantly better than a standard credit card arrangement because you have full control over the band online via the bPay portal. You can easily login and deactivate it.

You can’t do that with a credit card. You have to phone someone and go through the standard rigmarole. Worst case you’ve lost £20 — provided you were quick about it.

And, from my perspective at least, there is limited value in thieves stealing your bPay, provided you’re quick about noticing you’ve lost it. Thieves would need to be rather creative with their activities given the £20 limit. (Although auto top-up could rack up the exposure). For the avoidance of doubt though, there isn’t actually an ‘off’ switch — it’s a contact form you need to fill in to switch things off and Barclaycard will then send you out a replacement. You can also switch off the auto top-up with a simple command. So maximum exposure is £20 or whatever you’ve got on the band. I’ve actually got £34 loaded as a result of some auto top-ups. I can get that ‘returned’ with a simple click on the portal.

Is bPay Waterproof?

No idea. Theoretically. Well, is a credit card waterproof? I think so. I haven’t actually tried either. The plastic band is definitely waterproof and I doubt the contactless module will be worried by water. So — theoretically — you could go swimming with the band and pay for your entry, drinks and so on with just a tap of the wrist. Very convenient.

Available Until May 2015

It looks like bPay — in it’s current form — is publicly available until May 2015 — it’s definitely worth getting one if you work in or around the mobile and payments world.

I strongly recommend getting one so you can experience the use cases yourself. It’s terrifically liberating — but I do also have to point out that it’s a bit ‘low level frustrating’ as I don’t usually wear anything on my wrist.

Pick up a bPay at www.bpayband.co.uk.